Outsourced Compliance Officer Dubai: The Interim Solution for Licensed Financial Services

Getting a financial services license in Dubai shouldn't feel like solving a Rubik's Cube blindfolded. But that's exactly how it feels for most SMEs.

The problem isn't the idea of compliance. Everyone understands why regulations exist. The problem is finding someone qualified to handle it without hiring a full-time executive you don't need yet.

Here's what most Dubai business owners discover: You need a Compliance Officer before you can get licensed. But you can't afford to hire one full-time until you're actually operating. It's a catch-22 that kills momentum.

This is where outsourced compliance officers come in.

What Does a Compliance Officer Actually Do?

Let's start with the basics. A Compliance Officer isn't just someone who fills out paperwork and checks boxes.

In Dubai's financial services sector, your Compliance Officer is responsible for:

- Ensuring your business follows all regulations - This means understanding VARA rules (if you're in virtual assets), DFSA requirements (if you're in DIFC), or FSRA guidelines (if you're in ADGM). These aren't simple rulebooks. They're constantly evolving frameworks that require someone who actually knows what they're reading.

- Implementing anti-money laundering (AML) and counter-terrorist financing (CFT) controls - You need systems that prevent financial crime. Not just policies that sit in a folder. Real, working systems.

- Acting as the primary contact with regulators - When VARA or the DFSA has questions, your Compliance Officer is the person who responds. This requires someone who can speak their language.

- Monthly, quarterly, and annual reporting - Regulators don't ask nicely. They demand regular reports. Miss a deadline, and you're looking at fines or worse.

- Training your team on compliance matters - Everyone in your company needs to understand the basics. Your Compliance Officer makes sure that happens.

The challenge? Finding someone with 5+ years of relevant experience who's willing to work for a startup that hasn't launched yet.

The Dubai Licensing Maze

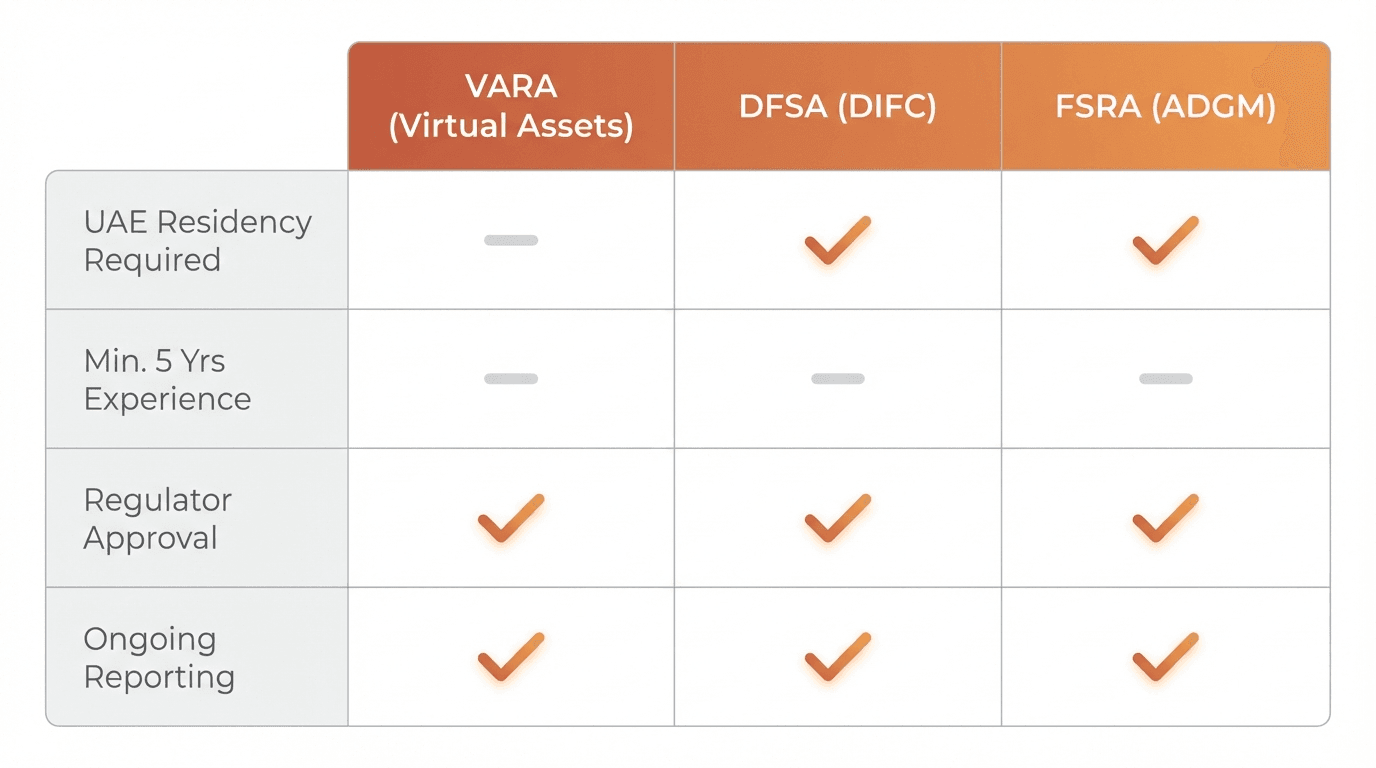

Dubai has three main regulators for financial services, and each has different requirements.

VARA (Virtual Asset Regulatory Authority)

If you're dealing with cryptocurrencies or digital assets, VARA is your regulator. Their rules are strict:

- Your Compliance Officer must be a full-time UAE resident

- They need 5+ years of relevant experience

- They must be approved by VARA as "fit and proper"

- They're personally responsible for AML/CFT oversight

VARA isn't playing around. In August 2025, they issued public fines against a licensed firm for governance and AML breaches. The message was clear: compliance failures have consequences.

The licensing process itself is complex. You need 25 compliance documents just to apply. Your Compliance Officer needs to be in place before you even submit your application.

DFSA (Dubai International Financial Centre)

The DFSA regulates financial services in DIFC. Their requirements are similarly demanding:

- All key personnel (including your Compliance Officer) must reside in the UAE

- You need to demonstrate competency and integrity

- Background checks are thorough

- The DFSA can reject candidates who lack a clear compliance track record

One interesting detail: The DFSA allows outsourcing for Category 4 firms and Restricted Fund Managers. For higher categories like asset managers or brokerage houses, outsourcing typically isn't permitted.

FSRA (Financial Services Regulatory Authority)

Operating in Abu Dhabi Global Market? The FSRA has similar requirements to the DFSA:

- UAE residency for key personnel

- Strong financial services background

- Mandatory regulatory training

- Annual CPD (Continuing Professional Development) requirements

The pattern is clear: all three regulators want someone who's actually here in the UAE, knows what they're doing, and can be held accountable.

Why Outsourcing Makes Sense for SMEs

Most Dubai SMEs don't need a full-time Compliance Officer on day one. Here's why:

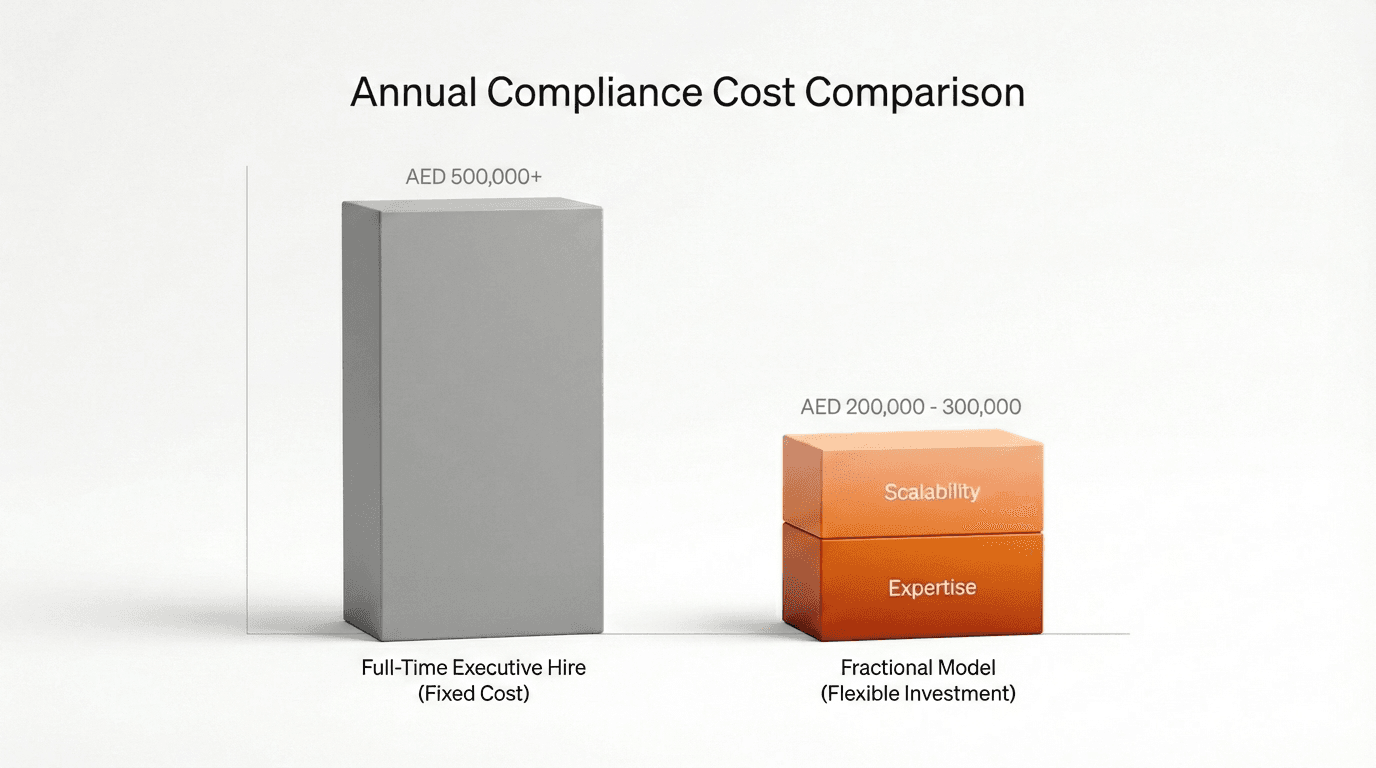

The math doesn't work yet. A qualified Compliance Officer with 5+ years of experience commands AED 25,000-40,000 per month, plus benefits. That's AED 400,000-600,000 annually. For a company that hasn't even launched yet, that's a massive burn rate.

Your needs fluctuate. During the licensing phase, compliance work is intense. Once you're operational, it becomes more routine. Why pay for full-time expertise when you need part-time support?

Finding talent is brutal. Dubai's financial services sector is competitive. Good compliance professionals have options. Convincing one to join an unproven startup is difficult.

Speed matters. Bringing on an outsourced Compliance Officer can happen in weeks, not months. They already have the credentials, the experience, and the regulatory relationships.

Outsourcing lets you access senior-level expertise at a fraction of the cost. You get someone who's already approved by regulators, who knows the submission process, and who can handle everything from licensing to ongoing reporting.

What Makes a Good Outsourced Compliance Officer

Not every compliance consultant is worth hiring. Here's what to look for:

Current Regulatory Approval

Your outsourced Compliance Officer needs to already be approved by the relevant regulator. If they're not, you'll wait months for approval. This defeats the purpose.

Ask: "Are you currently approved as a Compliance Officer by VARA/DFSA/FSRA?" If the answer isn't an immediate yes, keep looking.

Relevant Experience

Five years minimum isn't negotiable. But five years of what matters too.

Someone with five years at a major bank understands compliance differently from someone who spent five years at a fintech startup. Match their experience to your business model.

For virtual asset companies, look for someone who understands blockchain technology and crypto markets. For traditional financial services, find someone who knows banking regulations and securities law.

Active Engagement, Not Just Oversight

Some outsourced providers treat compliance as a once-a-month check-in. That's not enough.

You need someone who's actively involved. Someone who reviews your processes, trains your team, and catches problems before regulators do.

Strong Regulator Relationships

Compliance Officers who have good relationships with regulators make your life easier. They know who to call when you have questions. They understand how regulators think. They can navigate grey areas.

This matters more than most people realise. Regulations aren't always black and white. Having someone who can interpret requirements correctly saves you time and headaches.

Common Mistakes SMEs Make

We've seen these patterns repeatedly:

Mistake 1: Hiring Too Late

Many companies wait until they're ready to submit their license application before thinking about compliance. By then, it's too late.

Compliance needs to be built into your business from the start. Your processes, your documentation, your team training—all of this takes time.

Start looking for a Compliance Officer at least 3-4 months before you plan to apply for your license.

Mistake 2: Choosing Based on Price Alone

The cheapest option is rarely the best option. Compliance failures are expensive. Fines from VARA or the DFSA can run into hundreds of thousands of dirhams. License revocations mean starting over.

Pay for quality. It's cheaper in the long run.

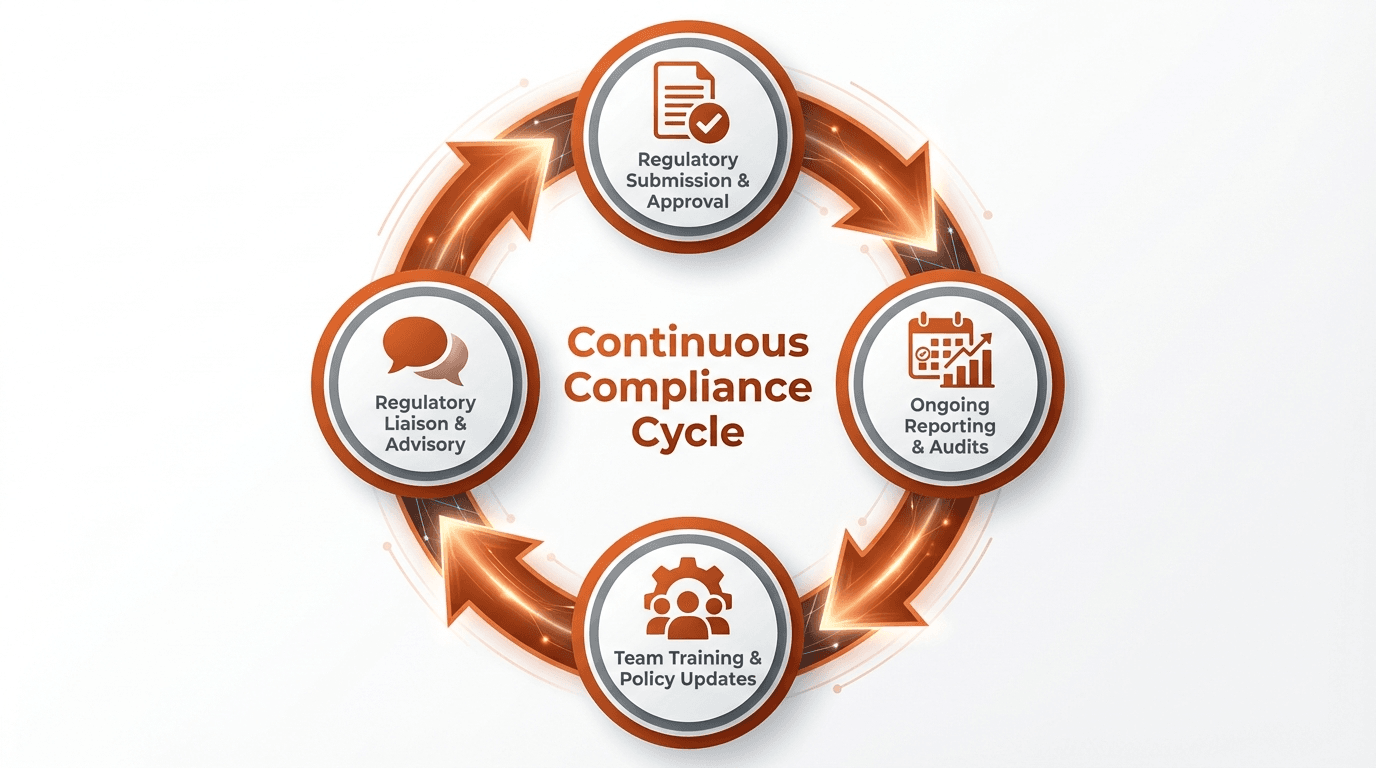

Mistake 3: Not Understanding the Ongoing Commitment

Getting licensed is just the beginning. Ongoing compliance requires:

- Monthly financial reporting (for VARA-licensed firms)

- Quarterly compliance reports

- Annual audits

- Regular team training

- Policy updates as regulations change

Your outsourced Compliance Officer needs to handle all of this. Make sure they're committed long-term, not just for the initial licensing phase.

Mistake 4: Assuming One Size Fits All

A Compliance Officer who's great for a cryptocurrency exchange might not be right for a payments company. Experience matters, but so does specialisation.

Look for someone who understands your specific business model and the unique risks you face.

The 2026 Regulatory Landscape

Compliance in Dubai is getting stricter, not looser.

VARA released Rulebook 2.0 in May 2025, with full compliance required by June 2025. The changes weren't minor tweaks - they were substantial updates to governance, reporting, and operational requirements.

The UAE is preparing for a FATF/MENAFATF mutual evaluation in June 2026. This means regulators are under pressure to demonstrate strong oversight. Expect enforcement to intensify.

For SMEs, this creates both challenges and opportunities. The challenge is keeping up with changing requirements. The opportunity is that companies with strong compliance stand out.

Having an experienced outsourced Compliance Officer helps you stay ahead of regulatory changes rather than scrambling to catch up.

How We Help

At Fractional Dubai, we've helped SMEs navigate the licensing process across VARA, DFSA, and FSRA jurisdictions.

Our fractional CFO services work alongside compliance expertise to ensure your financial reporting meets regulatory standards. Our fractional COO support helps you build operational processes that satisfy compliance requirements.

We understand that SMEs need flexibility. You don't need a full-time executive for every function. You need experienced professionals who can step in when needed and deliver results without the overhead.

Making the Decision

Here's how to decide if an outsourced Compliance Officer is right for you:

You should outsource if:

- You're pre-launch or early stage

- You need to minimise fixed costs

- You require immediate access to regulatory-approved personnel

- Your compliance needs are relatively straightforward

You should hire full-time if:

- You're doing significant transaction volume

- You have complex, high-risk operations

- You need daily oversight and team management

- You have the budget for AED 400,000-600,000 annually

For most SMEs, outsourcing is the right move. You can always transition to full-time later as your business scales.

Getting Started

The licensing process in Dubai doesn't have to be a nightmare. With the right compliance support, it's manageable.

Start by understanding which regulator governs your business. Then find an outsourced Compliance Officer who's already approved by that regulator and has relevant experience in your sector.

Don't wait until you're ready to submit your license application. Start building your compliance foundation now.

Ready to navigate Dubai's financial services licensing with confidence? The Fractional Dubai team can connect you with experienced compliance professionals who understand your sector and can get you licensed without the overhead of a full-time hire. Get in touch to explore how fractional compliance support can accelerate your launch.